NATSEM BUDGET: reflections on the 2016/17 federal budget

Scott Morrison is very keen for his first budget to be viewed as “not just another budget” – to the point of saying so not once, but twice, in the first three lines of his Budget Speech. Rather, it’s a “plan” – a word he used 29 times in his Speech – 28 times more than either Joe Hockey or Wayne Swan did in their respective first Budget Speeches[1]. By contrast, “jobs and growth” only got a run 16 times in the Budget Speech (plus another 8 mentions in Budget Paper No 1).

But while the Treasurer’s ‘plan’ does contain some bold and worthy initiatives – more on which anon – it is also in some ways a surprisingly unambitious document, especially for a Government which came to office pledging to “stop the debt” and fix the “budget emergency”. This year’s Budget Paper No 2, in which all the different ‘policy decisions’ taken in the lead-up to the Budget are listed and explained, and their impact on the budget ‘bottom line’ for each year of the forward estimates period set out, ran to only 172 pages, the smallest number since 1998-99[2].

More seriously, perhaps, the net impact of all the ‘policy decisions’ taken since December last year on the budget ‘bottom line’ amounts to just $1.5bn over the four years to 2019-20 – the smallest such figure in five years, and equivalent to just 0.02% of GDP over the forward estimates period. And more than all of that amount is contained in “decisions taken but not yet announced” in 2019-20, according to a line item on page 61 of Budget Paper No 2[3].

And because this relatively small amount of net savings is more than offset by another $11bn of adverse ‘parameter variations’ – chief among them the impact of slower wages growth on personal income tax collections – the budget deficit over the four years of the forward estimates period will in total be $6bn more than envisaged six months ago, $40bn more than projected in last year’s budget, and almost $84bn more than foreshadowed in the 2014-15 budget (Chart 1).

Chart 1: Successive estimates of the ‘underlying’ cash balance’

.png)

Source: Australian Government, Budget Paper No 1, Budget Strategy and Outlook and Mid-Year Economic & Fiscal Outlook 2013-14 through 2016-17.

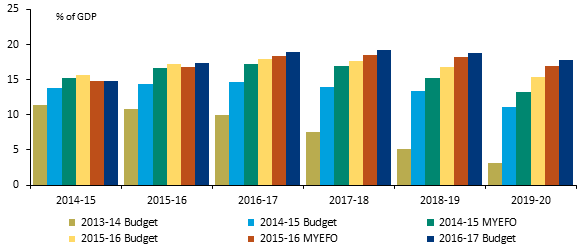

As a result, the Government’s net debt is now expected to peak at 19.2% of GDP in 2017-18 – more than a percentage point above the previous peak in the last year of the Keating Government, and almost 8 percentage points above the peak erroneously forecast for 2014-15 in Wayne Swan’s last budget, which the Coalition characterized as putting Australia in a fiscal position not far from that of Greece (Chart 2).

Chart 2: Successive estimates of net debt

Source: Australian Government, Budget Paper No 1, Budget Strategy and Outlook and Mid-Year Economic & Fiscal Outlook 2013-14 through 2016-17.

The longer-term projections still envisage the budget returning to surplus in the 2020-21 financial year – although the surpluses beyond that point fall well short of the Government’s stated long-term objective of 1% of GDP. And it would appear that more than half of those surpluses are attributable to the inclusion, from 2020-21 onwards, of the net earnings of the Future Fund, something which was slipped quietly into the long-term projections in last year’s budget.

These projections rest on economic assumptions which, though not at all implausible, nonetheless appear to have more downside risk to them than upside – in particular, that real GDP growth averages 3% pa from 2017-18 through 2022-23, and that Australia’s terms of trade stop falling after 2019-20.

The Government has clearly been conscious of the need to ensure that the measures contained in this budget can be portrayed as being ‘fair’. Certainly the changes to superannuation – reducing the generosity of the taxation treatment of superannuation contributions by high-income earners, limiting the scope for high-income earners to accumulate large superannuation balances through both pre- and post-tax contributions, and putting a cap on the amount which can be used to generate tax-free earnings in self-managed funds once they have moved into the ‘retirement phase’, offset by changes which eliminate the tax penalty effectively suffered by low-income earners on their superannuation contributions, and making it easier for people with fragmented careers (particularly women) to accumulate more adequate superannuation balances over their lifetimes – pass that test. And so do the ‘integrity measures’ directed at ensuring that multinational companies operating in Australia pay an appropriate amount of tax on the profits generated by their activities in Australia.

And although some will no doubt continue to portray it as ‘unfair’, I have no quarrel with the Government’s decision to allow the 2 percentage point ‘temporary deficit repair levy’ on taxpayers in the top income tax bracket to expire, as scheduled, at the end of the 2016-17 financial year.

There is no long-term good that can accrue to Australia by persisting with the English-speaking world’s second highest top marginal personal income tax rate, cutting in at the second-lowest top marginal income tax threshold in the English-speaking world, especially when there are so many avenues open to people in that top tax bracket to avoid paying it on some, or all, of their income. There are much more effective ways of extracting more tax revenue from high-income households – if governments want to do that – than imposing punitive top marginal rates.

The Government sees its program of annual reductions in the tax rate paid by ‘small’ companies, the progressive widening of the definition of what constitutes a ‘small’ company, and the eventual re-unification of the tax rate for ‘small’ and ‘large’ companies at 25% in 2026-27, as the core element in its ‘plan’ for ‘jobs and growth’.

While there is now a large – though by no means uncontested – body of evidence to support the contention that reductions in company tax rates can support faster rates of GDP growth and higher wages (by stimulating higher levels of investment and hence higher levels of labour productivity)[4], there is very little evidence of which I am aware which provides any compelling rationale for favouring small businesses in this regard over large ones. The significant preference which both this budget and its predecessor have extended to small businesses appears to owe much more to a desire to genuflect before an altar which the Coalition parties hold especially sacred than it does to any unambiguous economic rationale[5].

It is almost an article of faith among the Liberal and National Parties that small businesses are the ‘engine room of the economy’. The Treasurer in his Budget Speech asserted that ‘small and medium businesses are driving jobs growth in Australia and must continue to do so’.

While it’s true that small businesses – defined in ABS statistics as those employing fewer than 20 employees – account for 44% of total employment, as of the most recent available reading which is for 2013-14[6], they have accounted for only 18% of the increase in employment over the most recent five years for which data are available in this form (ie from 2008-09 through 2013-14). By contrast, firms with more than 200 employees – which the ABS defines as ‘large’ – have accounted for 52% of the increase in total employment over the past five years, despite accounting for less than 32% of total employment. Likewise, ABS statistics[7] show that large businesses are more likely to engage in ‘innovative activities’ than small ones, especially ones with 4 or fewer employees.

In other words, if the Government wanted to cut company taxes in a way that was most likely to result in increased job creation or higher levels of innovation (assuming that cutting company taxes would have that effect), it should have cut company taxes for large companies ahead of small ones. But that would have been exceedingly difficult, politically, in the current climate.

It’s also worth noting in passing that a significant proportion of the budgetary cost of cutting the company tax rate – especially for smaller companies which (as the Treasurer noted in his Budget Speech) are “overwhelmingly Australian owned” – will be ‘clawed back’ through a commensurate reduction in franking credits.

The new Youth Jobs Path program directed towards assisting young job seekers into employment seems much more effectively directed towards creating jobs than the myriad tax breaks for small businesses. This is a welcome reversal of the punitive approach to long-term unemployed young people than the one taken in the 2014-15 Budget.

The other key element of the Government’s ‘ten year enterprise tax plan’ is the increase in the tax threshold for the second-top marginal rate from $80,000 to $87,000, effective from 1 July this year. The government says this will prevent “average full time wage earners … from moving into the second highest tax bracket”.

As it does when talking about who does and who doesn’t benefit from negative gearing, the Government here elides between ‘gross’ and ‘taxable’ incomes. Average weekly total earnings for full-time adults are indeed now over $80,000 per annum. But that is a gross figure. People on those incomes claim deductions for work-related expenses, charitable donations, medical expenses and – as the Government and the property industry constantly remind us – for interest on negatively-geared property investments. Average taxable income in 2013-14 – the latest year for which figures are available – was $57,552. If that has increased since then at the same rate as average weekly total full-time adult earnings, then it would now be about $59,500 – a long way below $80,000.

The Budget seems to be saying to people with taxable incomes of less than $80,000 – if you want to pay less tax, get yourself a negatively-geared property investment.

The Budget is also arguably saying the same thing to people with taxable incomes of over $250,000, people who have already contributed $500,000 to superannuation over the course of their lifetimes, or people who already have at least $1.6mn in their superannuation accounts – if you put any more into superannuation, we are going to tax you more, but if you put it into a negatively-geared property investment, we won’t touch you, because (in the words of the Treasurer’s Budget Speech), “that would increase the tax burden on Australians just trying to invest and provide a future for their families”.

Of course, we are not talking about a large number of people here: and the ones we are talking about are extremely well-off. We are actually also talking about people who are much more likely to have a negatively geared property investment (or indeed, more than one), than people with taxable incomes of less than $80,000 per annum.

To re-iterate, I am quite comfortable with the Budget’s proposed changes to superannuation arrangements.But I can’t see why people – even wealthy people – who are “just trying to invest” through superannuation should be singled out for less generous tax treatment, while people who are doing exactly the same thing through negatively geared property (or other) investments should remain unscathed.

The Treasurer reportedly toyed with the idea of limiting “excesses and abuses” of negative gearing, for example by limiting the number of properties in respect of which losses could be claimed, or the total amount of losses which could be claimed, as a deduction against ordinary income in any given year[8] - which would have more or less exactly paralleled what the budget seeks to do with regard to superannuation.

The decision not to go down that path was reportedly “a political – and not an economic – move”[9].

But it has, and will have, economic consequences.

Combined with the Reserve Bank’s latest cut in official interest rates, the budget’s decisions and non-decisions with regard to income tax cuts, superannuation and negative gearing are likely to encourage more Australians to borrow more money in order to invest in the property market. As if Australia didn’t already have one of the developed world’s highest ratios of household debt to GDP or personal income, and amongst the developed world’s most expensive residential real estate[10]? And as if we might not be near the bottom of the interest rate cycle and the peak of the property price cycle?

Is it really consistent with building a “stronger, more diverse, new economy” – as Scott Morrison’s Budget Speech proclaims is the Government’s intention – to encourage still more Australians to bet, with borrowed money, that property prices will continue to rise at a faster rate than their incomes?

By the standards of previous pre-election budgets, this was a sober, responsible effort on the part of the Government. The Government has been conscious of the importance, if only to its own electoral prospects, of being seen to have been ‘fair’ in its mix of policy measures. The Government has rightly sort to focus support for superannuation on its stated purpose, and to ensure that multi-national companies pay a more appropriate amount of tax.

But the Government is unnecessarily, and perhaps dangerously, blinded by its allegiances to its belief in the inherent nobility of small businesses, and to the property industry – which have prevented it from delivering a better budget than it has.

Saul Eslake is a Vice-Chancellor’s Fellow at the University of Tasmania, and an independent consulting economist.

[1] And Wayne Swan used it as a verb, not a noun.

[2] All but the last of Wayne Swan’s Budget Paper No 2s had fewer than 300 pages, and two of them had more than 400.

[3] In reality, of course, the ‘net impact of policy decisions’ is the end result of a large number of different decisions with offsetting effects on receipts and payments. Among those are ‘decisions taken but not yet announced’ which will cost the budget an average of $535mn a year between 2016-17 and 2018-19, but then save almost $2bn in 2019-20.

[4] See, for example, Michael Kouparitsas, Dinar Prihardini and Alexander Beames, ‘Analysis of the Long Term Effects of a Company Tax Cut’, Treasury Working Paper 2016-02, 3 May 2016, available at http://www.treasury.gov.au/PublicationsAndMedia/Publications/2016/working-paper-2016-02.

[5] Although I note that the Labor Opposition has also previously proposed that the company tax rate for small businesses be cut to 25%.

[6] ABS, Australian Industry, 2013-14 (catalogue no. 8155.0). The 2014-15 edition should be released in late June.

[7] ABS, Selected Characteristics of Australian Business, 2013-14 (catalogue no. 8167.0).

[8] See, eg, Phil Coorey, “Scott Morrison’s negative gearing plan to hit the rich”, Australian Financial Review, 14th February 2016

[9] Karen Middleton, “The strange politics of negative gearing”, The Saturday Paper, 30th April 2016.

[10] See, eg, Bank for International Settlements, Total credit to the non-financial sector, March 2016 (available athttps://www.bis.org/statistics/totcredit/totcredit.xlsx), and International Monetary Fund, Global Housing Watch, April 2016 (available athttp://www.imf.org/external/research/housing/).