Deteriorating Finances of the ACT

The annual budget is a significant event in the calendar. Public servants preparing the budget finally get some relief. Ministers and government backbenchers have almost unlimited opportunities to appear in the media and attempt to talk up their superior financial management, the strength of the finances and the plans the Government has developed to spend public monies in ways that reflect the community’s needs and priorities. The fanfare and the media hype are unarguably justified, as the budget represents the most significant policy statement that a Government makes in any year.

By contrast the tabling of the annual financial reports is a subdued and dull affair. The legislation governing financial management typically mandates that such reports be presented as the accountability mechanism at the end of the year for the budget presented at the beginning of the year[i]. In the ACT the law requires, as it does in other jurisdictions, that the annual financial statements be audited by the Auditor-General[ii]. While the reports should, in principle, be of considerable importance to the community, their relative absence from the public discourse is, while understandable, nevertheless a pity.

The financial statements, being the product of the Auditor-General are devoid of the spin and self‑serving political messaging at the heart of most budget documents. They also commonly highlight the range of not so flattering features of a budget, especially of one that is under some stress, such as the ACT budget has been for the last eight years. It is, therefore, not surprising that the most recent Consolidated Financial Statements of the Australian Capital Territory[iii], which relate to 2018-19 and were tabled in December 2019, are of that ilk. They contain a dispassionate dissection of the state of the ACT finances and should be of interest to every Canberra resident. The timing of their release, just before the long summer break, and as close to Christmas as was possible, along with the general disposition of Auditors-General to maintain a low profile, meant, however, that this latest report on Territory’s finances was subject to no real examination or reporting in the mainstream media.

The report does reveal some alarming facts. Notably, by way of example, the audited statements showed that as at June 2019 the Territory’s superannuation liability was $11.776 billion or almost $4 billion (51%) higher than the amount reported in the 2018-19 budget, namely $7.804 billion, as well as the estimate of $7.812 billion published in June 2019 as part of the 2019-20 Budget.

The explanation provided by the Auditor-General for the increase in liability from $7.804 billion, as published by the Treasurer Andrew Barr in early June 2019[iv], to $11.776 billion at 30 June 2019 was as follows[v]:

The higher than expected superannuation liability is predominantly due to the higher than estimated valuation at 30 June 2019 as a result of using two different discount rates for budget estimates and actual. The discount rate of 5 percent was applied in the 2018-19 Budget, compared to 1.92 per cent at 30 June 2019. This rate is required by Australian accounting standards, and referenced to the yield on a suitable Commonwealth Government bond.

The point that the Auditor-General is highlighting is that the Treasurer provided an estimate of the superannuation liability for the purpose of the 2018-19 budget, as well as the 2019-20 budget, that was not based on the applicable accounting standard, which resulted in that estimate understating the liability by $4 billion.

The total superannuation liability represents the estimated financial obligation of the Territory to make payments to the Commonwealth Government in respect of superannuation arising from Territory employment[vi]. An understatement of $4 billion amounts to more than $20,000 in additional costs that every household in the Territory, based on the current population, will have to meet through future taxes, which was not disclosed at the time of the budget.

It is surely inconceivable that the ACT Government was unaware of the methodology employed by the Auditor‑General to determine the level of the ACT’s superannuation liability. There are also no possible grounds for the ACT Government to disagree with the calculation of the liability as presented by the Auditor‑General. The Statement of Responsibility accompanying the audited statement, provided by Treasurer confirms that in his opinion they fairly reflect the financial operations of the Territory during the year and the financial position of the Territory at the end of the year. The Statement of Responsibility provided by the Under Treasurer confirm that in his opinion the audited statements have been prepared in accordance with Australian Accounting Standards and requirements of the Financial Management Act 1996.

It is quite clear that the budget estimates and annual financial statements have been prepared on a quite different accounting basis, and that only one of those (the annual financial statements) comply with the Australian accounting standards.

A comparison of the budget estimate of superannuation liability over time and the audited result for each of the respective years reveals that the divergence described above appeared first after 2012 and has averaged 50% every year since.

One can only speculate as to why the ACT Government continues, year on year, to understate the level of its superannuation liability by 50 per cent or as the Auditor -General has calculated in the latest set of audited financial statements by just on $4 billion.

.png)

The above chart shows that over the past 6 years, the Territory’s annual budgets have understated its liability to the Commonwealth Government, and in turn, overstated the ACT’s financial position.

Indeed, the audited financial statements reveal an entirely different picture of the ACT’s financial operations and its financial position than that painted through successive annual budgets. In the following, we present the trajectory of some key metrics sourced from the audited statements for the past decade.

Net Operating Balance

Governments are not in the business of making profits, however, ability to balance revenues and expenditures is critical for ensuring the sustainability of services. A budget that is structurally in surplus provides capacity to withstand fiscal shocks as well as to make investments in social infrastructure without the deferral and transfer of costs to future generations.

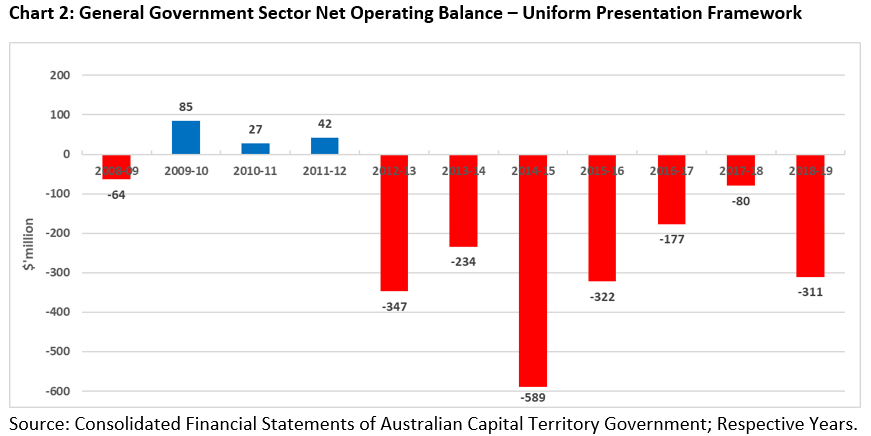

It is pertinent to note that the Uniform Presentation Framework (UPF) is utilized throughout Australia, by agreement between the Commonwealth and all State and Territory Governments and provides a common reporting basis for financial information in budget papers, budget updates and budget outcome reporting, in all jurisdictions. Chart 2 below illustrates the ACT Government Net Operating Balance (NOB) over the 10-year period from 2008-09 to 2018-19.

The Net Operating Balance (NOB), presented under the UPF, provides a true and fair measure of a Government’s operations because it reflects that part of an operating surplus related to government policy decisions and government operations, i.e., decisions over which the government has control. It excludes changes in the value of assets and liabilities resulting from market re-measurements - such as financial investments and non-financial fixed assets - which are beyond the government’s control. Chart 2 above shows actual results from the audited financial statements. Notably, the ACT Government has not recorded a surplus under this measure since 2011-12.

The 2018-19 audited financial statements show a deficit of $311 million. The 2019-20 Budget forecast a deficit of $286.8 million for the current year. The 2019-20 Budget Review released on 13 February 2020 forecasts this to deteriorate further to a deficit of $458.3 million[vii]. By way of comparison, the headline operating result has also deteriorated from the forecast deficit of $89.1 million to $255.6 million. However, as we mention above the net operating balance provides a truer reflection of a government’s operations and financial management.

Net Debt

Net debt is a useful measure by which to judge the overall strength of a Government’s fiscal position. A positive position indicates that cash reserves and investments are lower than gross liabilities which means of course that the Government will need to call on future revenues to service these liabilities. A negative position indicates that cash reserves and investments are greater than gross liabilities which means that the Government has sufficient reserves to meet those liabilities, and all else being equal, it will not need to increase taxes for this purpose.

.png)

Net debt has increased by $3.2 billion over the past ten years. Most notably, the Territory was in a negative net debt position until 2012. Since 2013, net debt has increased at a compounding rate of 65% per annum. This represents more than $18,000 for every Canberra household in increased debt costs that would need to be met through future taxation.

The 2019-20 Budget Review released on 13 February 2020 highlights considerable further deterioration, with the June 2020 estimate increasing from the original forecast of $2.216 billion to $2.714 billion. This represents 46% of the operating revenues. The Budget Review forecasts the net debt to further increase to $4.030 billion, which is equal to 63% of the operating revenue. Notwithstanding the low interest rate environment, such increase in net debt is unsustainable. It also poses significant risk, as just a 1% increase in interest rates would require the operating budget to accommodate an additional $40 million in interest costs, requiring increase in taxation or cut in services. To put this in context, the Budget Review indicates that the interest costs for 2019-20 are forecast to be $214.690 million.

Net Financial Liabilities

Net financial liabilities takes into account unfunded superannuation liabilities and provides a broader measure of debt than net debt[viii].

.png)

Net financial liabilities have increased by $8.8 billion over the past decade, with most significant increases occurring after 2011 at a compounding annual rate of 20%. Once again, such an increase in net financial liabilities is unsustainable. The liabilities must be discharged by the existing households as well as by future generations. For the current households, over the last decade, an additional burden of more than $50,000 per household has been added.

Net Financial Worth

Net Financial Worth is the amount by which total financial assets exceed financial liabilities. It is a measure of net holdings of financial assets.

.png)

The Territory’s net financial worth declined from positive $3.3 billion in 2009 to negative $3.3 billion; a turnaround of $6.6 billion, with almost the entire deterioration occurring after 2011.

Conclusion

The above metrics highlight significant deterioration in the Territory’s financial position. The increase in liabilities, and the relative decrease in financial assets to meet those liabilities means that there will be increasing calls on future generations to fund expenditure incurred by this generation. Transfer of liability to future generations raises inter-generational inequities. In particular, the inter-generational impact of financial liabilities of this order needs to be better understood in order to ensure that we are not selfishly transferring costs that we should in all fairness be bearing ourselves rather than imposing on our children and grandchildren[ix].

Residents of Canberra would be justified in asking, in light of the deteriorating financial and operating position of the Territory, for the evidence, at the very least, of a commensurate improvement in community assets and the quality of services.

[i] For the ACT, the The Financial Management Act 1996 sets out the requirements for the preparation of Territory budget in Section 11, and Annual Financial Statements of the Territory in Section 22.

[ii] Financial Management Act 1996; Section 24.

[iii] Australian Capital Territory Government (2019); Consolidated Annual Financial Statements 2018-19; Available online at https://apps.treasury.act.gov.au/__data/assets/pdf_file/0017/1440206/2018-19-Consolidated-Annual-Financial-Statements.pdf.

[iv] Australian Capital Territory Government (2019); 2019-20 Budget Paper No. 3; GGS GFS/GAAP Harmonised Financial Statements, Page 318.

[v] Consolidated Annual Financial Statements 2018-19; Appendix A, Page 82.

[vi] ibid; Appendix B, Page 95.

[vii] Australian Capital Territory Government (2020); 2019-20 ACT Budget Review; GGS GFS/GAAP Harmonised Financial Statements, Page 109.

[viii] Net financial liabilities is calculated as total liabilities less financial assets (such as cash reserves and investments). It takes into account all non-equity financial assets but excludes the value of equity held by the General Government Sector (GGS) in public corporations.

[ix] The Financial Management Act 1996 requires that budget be prepared taking into account the principles of responsible fiscal management and the object of providing a basis for sustainable social and economic services and infrastructure fairly to all ACT residents (Section 11(5)(a) and (b) respectively). The principles of responsible fiscal management are defined in Section 11 (7) of the Act and include, among others, ensuring that the total liabilities of the Territory are at prudent levels to provide a buffer against factors that may impact adversely on the level of total Territory liabilities in the future, and ensuring that, until prudent levels have been achieved, the total operating expenses of the Territory in each financial year are less than its operating income levels in the same financial year.