Heavy Lifting on Tax Reform

The Chief Minister and Treasurer, Andrew Barr, has been reported as saying the “heaviest lifting” of the territory’s tax reform was over. Seven years into the 20-year reform, this should be welcome news particularly for those households experiencing severe stress because of the increased burden of rates and other charges.

The Chief Minister did not elaborate on what he meant by “heaviest lifting”. The term is capable of a range of meanings and is relative. Most significantly, the Chief Minister also did not acknowledge that for low and medium income households the taxation weight being “felt” by them has been immense.

One was surely entitled to conclude, however, from the Treasurer’s belief that significant progress has been made on the reform and that most of the pain is over.

Unfortunately, the Treasurer’s assurance that the worst is over is not borne out by an examination of progress to date.

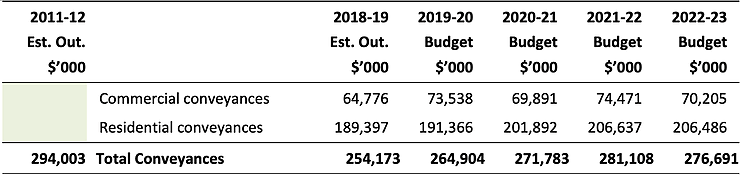

In the 2011-12 financial year, the year before the reform commenced, conveyance duty was estimated at $294 million. This is accordingly the amount that was in principle planned to be transferred to general rates over the 20-year transitional period agreed on for implementation of the reform. If the heavy lifting on the abolition of this tax had been done in the first seven years, it is reasonable to expect that revenue from it would by now have reduced by at least one third, or $100 million.

Source: Budget Paper No. 3; 2011-12 and 2019-20.

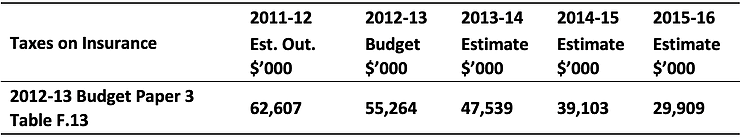

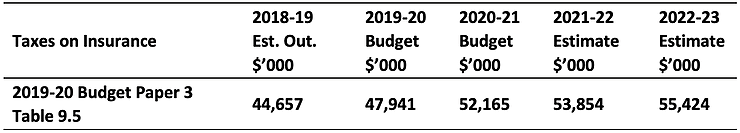

Source: Budget Paper No. 3; 2011-12 and 2019-20.

The just released budget papers, however, forecast $265 million from conveyance duty in 2019-20, increasing to $281 million in 2021-22. In other words, the government is still collecting almost as much in conveyance duty as it was in the year before the “heavy lifting” commenced. This is because while effective tax rates have decreased to varying degrees across the spectrum of property values, the government’s land supply policy, in particular, its focus on maximizing land sale revenue by restricting supply, has driven median house prices up by 5.4 percent per annum since 2012, thus negating any benefits from the reduced tax rates. Indeed, a family purchasing a median priced house in 2018 payed almost $3,300 more in stamp duty and $200,000 more in the price of the dwelling than they would have paid in 2012.

As with conveyance duty, taxes on insurance are also considered to be economically inefficient, and were to be abolished under the reform. These taxes were forecast to progressively reduce from approximately $63 million in 2011-12 to $30 million in 2015-16, with the foregone amount of revenue transferred to general rates.

However, in the 2019-20 budget, insurance taxes are forecast to actually increase to more than $55 million, which is only marginally less than the amount collected in 2012. Duties on general insurance and life insurance policies were indeed abolished over the first five years of reform, with the revenue foregone replaced by an increase in general rates, but they were then replaced by another insurance tax – the Life Time Care and Support Levy. Through this apparent sleight of hand, the government is not only double dipping but the reform is clearly not revenue neutral.

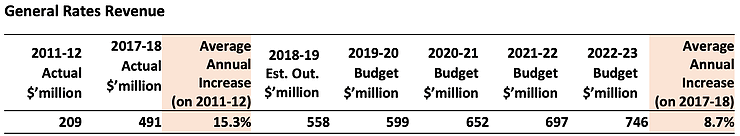

General rates have increased from a base of $209 million in 2011-12 to $491 million in 2017-18, at a staggering compounding average annual rate of 15.3 percent. Increase in dwelling stock (that is, the number of properties) does not explain the magnitude of this annual increase. According to the Australian Bureau of Statistics, the number of dwellings in the ACT increased at a rate of 1.9 percent annually between 2011 and 2016.

It is difficult to understand how the massive increase in revenue that the government is reaping can have been achieved only through revenue replacement and the increase in the number of dwellings in Canberra. The amount of increase suggests that there have been other changes to the rating system, beyond revenue replacement and the increase in the stock of dwellings in Canberra. If this is the case, then the government should explain what those changes have been.

Looking forward to 2022-23, the budget forecasts general rates increasing to $746 million; an annual average rate of 8.7 percent over the 2018 audited results. This may be somewhat lighter lifting when compared to the increase of 15.3 percent annually since 2011-12, however, it is heavy lifting by any standard.

Besides the quantum of increase in the taxation burden on households and businesses, there is a major concern about how the increase has been distributed. Canberra’s relatively higher incomes are often cited as evidence of ‘capacity to pay’. Average income in the ACT is indeed higher than the national average. Averages, however, mask significant income disparity. Gross household income for the lowest income quintile in Canberra is approximately one quarter of the average income, and just one tenth of the income in the highest quintile.

Based on a standard approach to determine the distributional impacts, we estimate that the impact of a flat tax on a household in the lowest income quintile will be two and half times larger than an ‘average’ household, and more than 5 times the impact on a household in the highest income quintile.

A progressive taxation policy would therefore ensure that relatively smaller amounts are applied to households on lower incomes. Sadly, the taxation reform has failed to achieve this. Perversely, properties with lower unimproved land values have seen relatively much larger increases in rates compared to those with higher land values.

Compounding the unfair impact of the new rates regime, safeguards in the concession system have been severely eroded. For example, in 2011-12, pensioners paid a net cost of $124.90 for the flat component of general rates and the fire levy after the application of rebates. In 2019-20, they will pay $421 or an increase of 229 percent because the pensioner rebates have been frozen since 2015-16 while the flat charge and the fire levy have been increased by 20 percent and 238 percent respectively.

For low to moderate income households, the heavy lifting acknowledged by the Chief Minister has been crushing and there is no sign that it will be lifted anytime soon, unless of course the government resolves to return to the principles underlying the reform or abandons it altogether.